The Hidden Complexity Behind Vape Compliance

Many businesses discover too late that compliance isn’t just about PACT Act reporting. Excise taxes vary by state, sales & use taxes apply more often than expected.

Managing these rules without support quickly becomes overwhelming.

PACT ACT

- The PACT Act applies to every vape shipment, wholesale or retail.

- It requires age verification at checkout and delivery, detailed customer record-keeping, and monthly reporting to each state.

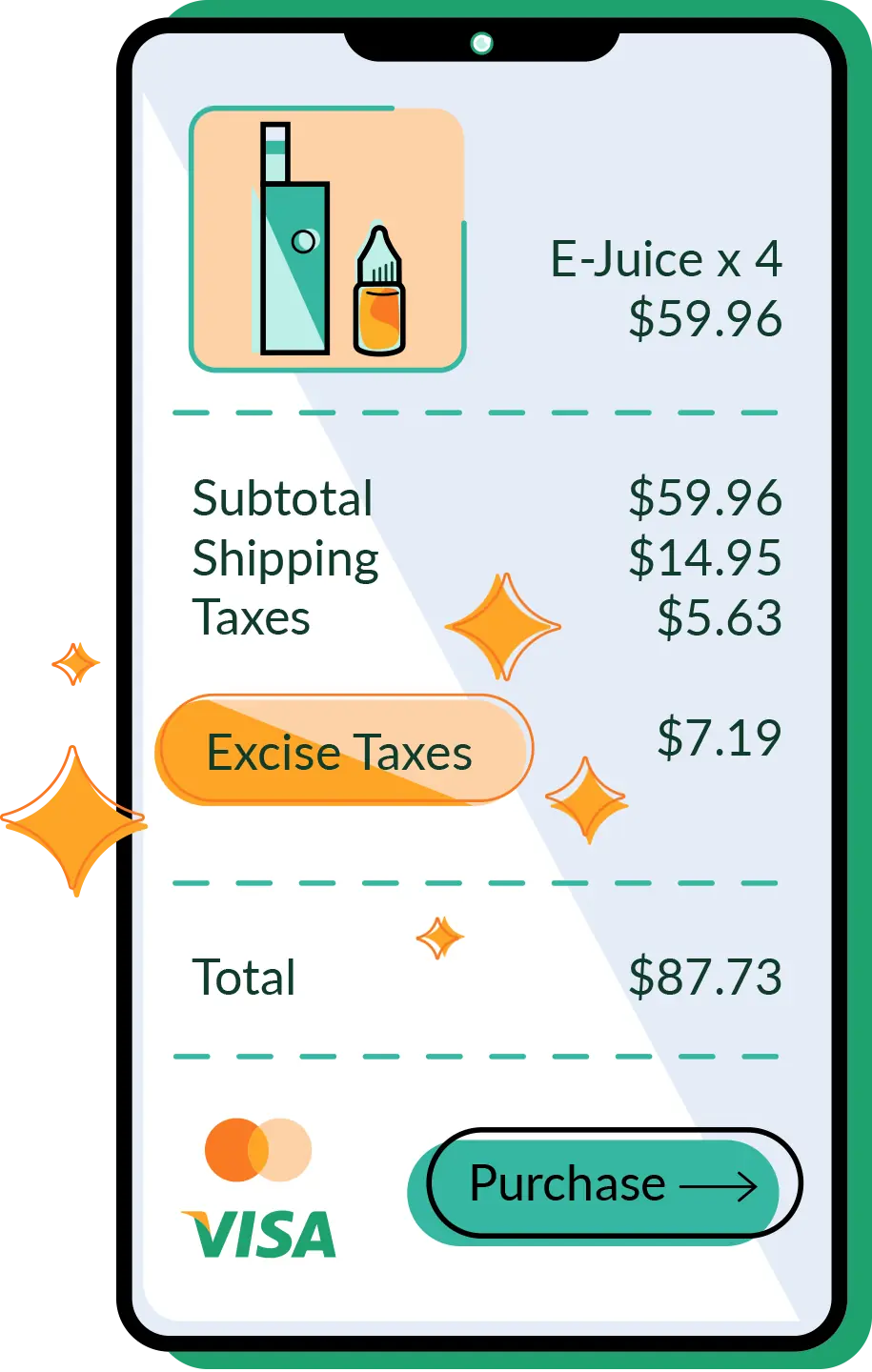

Excise Taxes

- Over 30 states tax vape products, and a growing number now tax nicotine pouches—rates vary by state, product type, and size.

- Manual calculation is error-prone, especially at checkout.

Sales & Use Tax

- Sales and use tax (SUT) often apply in addition to excise taxes.

- After the Wayfair decision, states can require collection without physical nexus, so assuming it is handled downstream creates costly gaps.

AUTOMATICALLY CALCULATE CORRECT RATES

Sell into more states

States layer their own PACT Act rules on top of unique excise and sales taxes, and the requirements keep

shifting. Managing it yourself only limits where and how you can sell.

Token of Trust removes those limits with automated tax compliance for vape businesses, giving you accurate

rates, confident filings, and room to expand into new markets.

Why Vape Businesses Choose Token of Trust

The most successful vape businesses treat compliance as part of their growth strategy. With the right vape compliance software, you’ll:

How It Works

We provide end-to-end multi-state vape compliance, automating everything from tax calculation to filing so you can focus on growth instead of paperwork.

DETERMINATION

Calculate excise, sales & use, and PACT Act tax obligations in real time based on product type, order details, and state-specific rules.

COLLECTION

Automatically collect the correct vape excise and sales taxes at checkout, ensuring every transaction is compliant.

REPORTING

Generate audit-ready reports for vape tax reporting across PACT Act, excise taxes, and sales & use taxes—consolidated in one platform.

SUBMISSION

File state and local tax returns with confidence—faster, more accurate, and always on time.

Try It Yourself: Free Tools Built for Compliance

Use these tools to see how complex vape tax compliance really is and how much easier it could be.

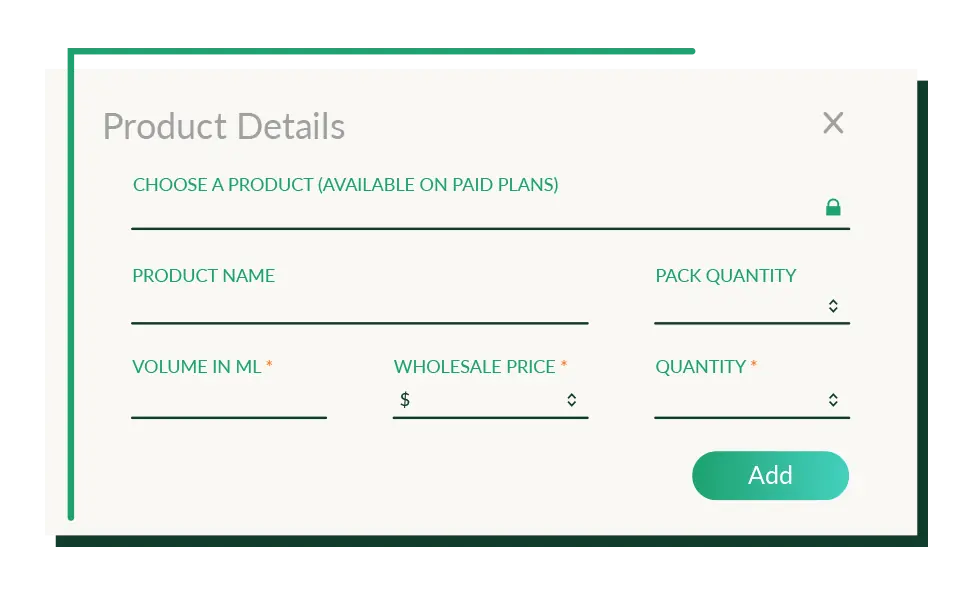

Instantly calculate excise taxes for vape products in any U.S. jurisdiction.

Enter your product details and shipping location to see where your products are taxable—based on the latest state, county, and city regulations.

Calculate tax rates

Get a downloadable summary of excise tax rules across states.

Stay informed about where taxes apply and at what rate.

Download jurisdiction sheet

Your All-in-One Solution for Vape Taxes and Compliance

Token of Trust offers all-in-one vape business compliance software designed for DTC brands, B2B suppliers, and ecommerce marketplaces.

Our platform unifies PACT Act reporting, excise tax reporting, sales and use tax compliance, and age verification in a single automated solution.

Token of Trust generates and submits PA-2 and state-specific reports, with optional age verification at checkout or delivery. You get timely, accurate filings without the manual work.

Common Vape Compliance Questions Answered

PRICING

Transparent plans and pricing.

Every vape business faces a different compliance maze—what you owe depends on what you sell, where you ship, and how you grow. That’s why our cost estimator gathers the details that matter most and provides a tailored quote for your vape business compliance needs.

Expand your business with Token of Trust

Handle PACT Act reporting, excise taxes, and sales & use tax in one platform. Token of Trust automates compliance so you can sell into more states, protect revenue, and focus on growth.

© 2025 Token of Trust®. All rights reserved